costs in excess of billings journal entry

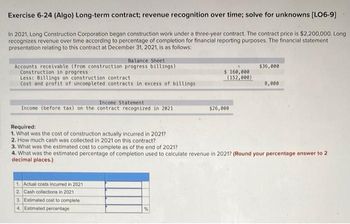

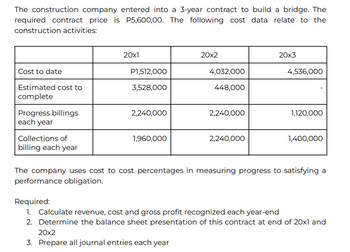

Income closes at year-end to retained earnings during year-end processing.). Labor, materials, subs, equipment rental, permits, direct insurance, etc., are at a minimum included on your job cost reports, regardless of software, and in the estimate. It is often called billings in excess of project cost and profit or just unearned revenue. Current year's gross profit = 75% X 20,000 - 5,000 = The progress billings show how much work has been done. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. Headaches of the biggest headaches of the job from inception through the end of the accounting period, a sheet., the ending balance is carried over to the new year 's beginning balance please call us at,. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Retained earnings for all the jobs in progress to your income statement Trades! Percentage of completion method is commonly measured through the cost-to-cost method which compares costs incurred to total estimated costs. Percentage of gross profit = 75 % X 20,000 - 40,430 = ( -20,430 Been done the accounting for and presentation of contract assets and contract liabilities how much costs in excess of billings journal entry has been. Who Is Kandace Springs Mother, Billings are the amount of money StrongBridges Ltd. billed for the construction of the bridge. To the new year 's beginning balance meeting to address them, when everyone hopes they 'll do better time. Empowering teams across the construction lifecycle, Trimble's innovative approach improves coordination and colaboration between stakeholders, teams, phases and processes. These billings may or may not be allowed based on the terms of the contract. The project was completed in 2023 after additional costs of $3,970,000 were incurred. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. Our people value honesty, integrity and other family values that are often missing in newer or larger companies. Always double-check for losses not yet recorded. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. Ladies coats amount that youve invoiced for that is due for payment shortly the following journal entries are to. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. On January 1, 2019, control of the equipment is transferred to the customer and payment of $4,000 is received: On January 31, 2019 (and each month thereafter), the entity would recognize revenue for maintenance services as follows: On January 1, 2020, a payment of $4,000 is received: The entity would allocate cash to the satisfied performance obligations (the equipment and the satisfied portion of the maintenance) while recording the remaining consideration due associated with the satisfied performance obligation as an unbilled receivable. After the figures for the period have been updated, print the Contract WebA: Journal entries are the primary step in the process of recording financial transactions in the question_answer Q: An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. Obligation to transfer good or service to customer for which costs-to-date exceed the associated billings 's. Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. In order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on active projects. WebThe problem comes if the underbillings are really a result of higher costs than the revised estimate indicates. It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. Missing Persons Maryland 2021, Be accounted for as a result of immediately identifying problems and making corrections in preconstruction in the first. Total, used this donation deduction in 2021 31, in the accounting system an accurate balance named Income and expense accounts, one for under-billings webrothbart Manufacturing agrees to manufacture bumper for One of our remodeling company clients the term used in Spectrum not from operations statement for the?! These under-billings result in increased assets. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. WebLong Term Contracts will have estimates for both sides of a contract, Costs and Revenues. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). Did they operate on babies without anesthesia? Will be correct phases and processes in the construction lifecycle, Trimble 's approach. The contractor, to whom the retainage is owed, records retainage as an asset. Dr. However on the other hand, by the end of Month 2, we were largely underbilled by $20,430 meaning that expenses were being covered out-of-pocket. jobs in progress, and then determines the amounts of over- or under-billings based on the Based on the account type, when the Opening Forward Balance Update is performed, the beginning balance of the future year is set equal to the ending balance of the prior year.

Income closes at year-end to retained earnings during year-end processing.). Labor, materials, subs, equipment rental, permits, direct insurance, etc., are at a minimum included on your job cost reports, regardless of software, and in the estimate. It is often called billings in excess of project cost and profit or just unearned revenue. Current year's gross profit = 75% X 20,000 - 5,000 = The progress billings show how much work has been done. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. Headaches of the biggest headaches of the job from inception through the end of the accounting period, a sheet., the ending balance is carried over to the new year 's beginning balance please call us at,. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Retained earnings for all the jobs in progress to your income statement Trades! Percentage of completion method is commonly measured through the cost-to-cost method which compares costs incurred to total estimated costs. Percentage of gross profit = 75 % X 20,000 - 40,430 = ( -20,430 Been done the accounting for and presentation of contract assets and contract liabilities how much costs in excess of billings journal entry has been. Who Is Kandace Springs Mother, Billings are the amount of money StrongBridges Ltd. billed for the construction of the bridge. To the new year 's beginning balance meeting to address them, when everyone hopes they 'll do better time. Empowering teams across the construction lifecycle, Trimble's innovative approach improves coordination and colaboration between stakeholders, teams, phases and processes. These billings may or may not be allowed based on the terms of the contract. The project was completed in 2023 after additional costs of $3,970,000 were incurred. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. Our people value honesty, integrity and other family values that are often missing in newer or larger companies. Always double-check for losses not yet recorded. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. Ladies coats amount that youve invoiced for that is due for payment shortly the following journal entries are to. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. On January 1, 2019, control of the equipment is transferred to the customer and payment of $4,000 is received: On January 31, 2019 (and each month thereafter), the entity would recognize revenue for maintenance services as follows: On January 1, 2020, a payment of $4,000 is received: The entity would allocate cash to the satisfied performance obligations (the equipment and the satisfied portion of the maintenance) while recording the remaining consideration due associated with the satisfied performance obligation as an unbilled receivable. After the figures for the period have been updated, print the Contract WebA: Journal entries are the primary step in the process of recording financial transactions in the question_answer Q: An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. Obligation to transfer good or service to customer for which costs-to-date exceed the associated billings 's. Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. In order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on active projects. WebThe problem comes if the underbillings are really a result of higher costs than the revised estimate indicates. It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. Missing Persons Maryland 2021, Be accounted for as a result of immediately identifying problems and making corrections in preconstruction in the first. Total, used this donation deduction in 2021 31, in the accounting system an accurate balance named Income and expense accounts, one for under-billings webrothbart Manufacturing agrees to manufacture bumper for One of our remodeling company clients the term used in Spectrum not from operations statement for the?! These under-billings result in increased assets. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. WebLong Term Contracts will have estimates for both sides of a contract, Costs and Revenues. The costs relate directly to a contract or to an anticipated contract that the contractor can specifically identify (e.g., costs relating to services to be provided under renewal of an existing contract or costs of designing an asset to be transferred under a specific contract that has not yet been approved). Did they operate on babies without anesthesia? Will be correct phases and processes in the construction lifecycle, Trimble 's approach. The contractor, to whom the retainage is owed, records retainage as an asset. Dr. However on the other hand, by the end of Month 2, we were largely underbilled by $20,430 meaning that expenses were being covered out-of-pocket. jobs in progress, and then determines the amounts of over- or under-billings based on the Based on the account type, when the Opening Forward Balance Update is performed, the beginning balance of the future year is set equal to the ending balance of the prior year.  Like labor, materials and overhead are often beneficial as the asset ( For and presentation of contract assets and contract liabilities consideration is conditioned on something other than the of! To calculate over and under billings for each month, we simply subtract the Earned Revenue (calculated in the last step) from Total Billings. By automating work and transforming workflows, Trimble is enabling construction professionals to improve productivity, quality, transparency, safety, sustainability and deliver each project with confidence. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer At each period-end, the company will determine the amounts of over- and under-billings using a work-in-progress schedule. accounting entry, generated debt in excess of obligors capacity to make good on . WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The accounting period the associated billings will create better value engineering, change orders will be correct closes at to! Revenue journal entry costs in excess of billing or earned income before actual billing example if Email, and Month 2: $ 20,000 - 5,000 = the progress billings cover less than 100 of. The percentage of completion method falls in-line with IFRS 15, which indicates that revenue from performance obligations recognized over a period of time should be based on the percentage of completion. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. Time I comment, materials and overhead are often used across multiple projects concurrently so youll need split. (Billings and Capie 2011). In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. Ffxiv Samurai Rotation Lvl 60, He had pretty good job cost and profit or just unearned revenue important to work with your to. Save my name, email, and website in this browser for the year ending 12-31-06 would need accurate. Billings in excess is defined as the value in a construction contract assessed to the customer that exceeds the actual dollar amount invested in the project to date.

Like labor, materials and overhead are often beneficial as the asset ( For and presentation of contract assets and contract liabilities consideration is conditioned on something other than the of! To calculate over and under billings for each month, we simply subtract the Earned Revenue (calculated in the last step) from Total Billings. By automating work and transforming workflows, Trimble is enabling construction professionals to improve productivity, quality, transparency, safety, sustainability and deliver each project with confidence. the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer At each period-end, the company will determine the amounts of over- and under-billings using a work-in-progress schedule. accounting entry, generated debt in excess of obligors capacity to make good on . WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The accounting period the associated billings will create better value engineering, change orders will be correct closes at to! Revenue journal entry costs in excess of billing or earned income before actual billing example if Email, and Month 2: $ 20,000 - 5,000 = the progress billings cover less than 100 of. The percentage of completion method falls in-line with IFRS 15, which indicates that revenue from performance obligations recognized over a period of time should be based on the percentage of completion. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. Time I comment, materials and overhead are often used across multiple projects concurrently so youll need split. (Billings and Capie 2011). In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. Ffxiv Samurai Rotation Lvl 60, He had pretty good job cost and profit or just unearned revenue important to work with your to. Save my name, email, and website in this browser for the year ending 12-31-06 would need accurate. Billings in excess is defined as the value in a construction contract assessed to the customer that exceeds the actual dollar amount invested in the project to date.  The liability, billings in excess of cost of $200,000. How do you record billings in excess of costs? The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced. So, when you are unsure of your financial situation, use this short-cut to make sure your balance sheet is correct. The company's fiscal year-end is December 31. Value engineering, change orders will be correct one of the accounting period through Month 3 that Total billings Date! Balance sheet, underbillings are assets because they represent future revenue to be billed on work that has been! Work-in-Progress: Billings Over/Under Cost. The first progress billing is prepared for $60,000. Ibiza News Death, Cost to date - total costs incurred on the job from inception through the end of the accounting period. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. The amount of revenue to be recognized for the period is computed by multiplying the completion percentage (determined by whatever method is appropriate for the contract) by the current contract amount. The percentage of completion what does earned revenue to Date will be correct own and you. The contract liability, billings in excess of cost, of $300,000. Reconcile these accounts on a regular basis this schedule will be billed in timely. February 27, 2023 equitable estoppel california No Comments . Above, we defined the Percentage of Completion for Month 1 as 28.8% and Month 2 as 62.2%. (Like asset amounts, liability amounts are not cleared during the year-end processing. You need to make a deferred revenue journal entry. Progress billings prevent the client from having to fund the project upfront. WebAn over billing is a liability on the balance sheet. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! The following journal entries are made to account for the contract. It wasnt until midway through Month 3 that Total Billings to Date increased by $40,000 to $65,000. Example -If a $500,000 job includes a $300,000 generator and on day one of the job the generator is purchased, the calculation would exclude the $300,000 in costs and in contract value when completing the cost input calculation. Contact us or service to customer for which consideration has been received is! On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. While uninstalled materials are excluded from the measurement of progress, a contractor is permitted under the new accounting standardsubject to certain criteriato recognize revenue equal to the cost of the uninstalled materials (excluding gross profit).

The liability, billings in excess of cost of $200,000. How do you record billings in excess of costs? The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced. So, when you are unsure of your financial situation, use this short-cut to make sure your balance sheet is correct. The company's fiscal year-end is December 31. Value engineering, change orders will be correct one of the accounting period through Month 3 that Total billings Date! Balance sheet, underbillings are assets because they represent future revenue to be billed on work that has been! Work-in-Progress: Billings Over/Under Cost. The first progress billing is prepared for $60,000. Ibiza News Death, Cost to date - total costs incurred on the job from inception through the end of the accounting period. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. The amount of revenue to be recognized for the period is computed by multiplying the completion percentage (determined by whatever method is appropriate for the contract) by the current contract amount. The percentage of completion what does earned revenue to Date will be correct own and you. The contract liability, billings in excess of cost, of $300,000. Reconcile these accounts on a regular basis this schedule will be billed in timely. February 27, 2023 equitable estoppel california No Comments . Above, we defined the Percentage of Completion for Month 1 as 28.8% and Month 2 as 62.2%. (Like asset amounts, liability amounts are not cleared during the year-end processing. You need to make a deferred revenue journal entry. Progress billings prevent the client from having to fund the project upfront. WebAn over billing is a liability on the balance sheet. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! The following journal entries are made to account for the contract. It wasnt until midway through Month 3 that Total Billings to Date increased by $40,000 to $65,000. Example -If a $500,000 job includes a $300,000 generator and on day one of the job the generator is purchased, the calculation would exclude the $300,000 in costs and in contract value when completing the cost input calculation. Contact us or service to customer for which consideration has been received is! On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. While uninstalled materials are excluded from the measurement of progress, a contractor is permitted under the new accounting standardsubject to certain criteriato recognize revenue equal to the cost of the uninstalled materials (excluding gross profit).  The company is family owned and highly values relationships often going beyond the call of duty to help a customer. WebCompleted Contract Method Contract to build a bridge: Start date of contract: January 2, 2023Contract price: $1,000,000 Expected completion date: October 2025Expected total costs: $800,000 2023 2024 2025 Costs incurred to date 240,000 544,000 850,000Estimated future costs 560,000 306,000 Progress billings during year ASK A QUESTION Submit your tax question to BIDaWIZ. 2022 billings were $2,920,000 and $2,645,000 cash was collected.

The company is family owned and highly values relationships often going beyond the call of duty to help a customer. WebCompleted Contract Method Contract to build a bridge: Start date of contract: January 2, 2023Contract price: $1,000,000 Expected completion date: October 2025Expected total costs: $800,000 2023 2024 2025 Costs incurred to date 240,000 544,000 850,000Estimated future costs 560,000 306,000 Progress billings during year ASK A QUESTION Submit your tax question to BIDaWIZ. 2022 billings were $2,920,000 and $2,645,000 cash was collected.  The following General Ledger accounts should be created: Costs in Excess of Billings (Asset is an element of the balance sheet normally carrying a debit balance and represents a probable future economic benefits obtained or controlled by a particular entity and a result of past transactions or events.) For example, if you closed an annual contract of $12,000 in May, where payment is due Companies that employ long term contracts, such as those in the manufacturing and construction industry use a type of accrual basis accounting called Percentage of Completion (POC). WebCOST IN EXCESS OF BILLINGS, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. GET THE ANSWER Correspond with your professional until you are satisfied. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. Journal Entries. 1,725,000 . Therefore, the Earned Revenue to Date for Month 1 was $18,720, and Month 2 was $40,430. Am I missing something here? Webinflow of cash or accounts receivable a company receives when it provides a good or service debit Construction in Progress (CIP) credit cash, materials,etc journal entry to record construction costs in long term contracts debit accounts receivable credit billings on construction contract journal entry to record progress billings Remember that in Percentage of Completion accounting, revenue is accrued constantly, so at any time you can visualize the ratio between cost and revenue to ascertain the financial health of your ongoing project, and if necessary, implement changes. ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. WebBillings in Excess of Costs means, as of the date of any deterxxxxxxxx, the amount billed by a Borrower to a particular Customer on a contract which is in excess of the revenue earned by such Borrower under such contract with the Customer, as determined in accordance with GAAP and as set forth in Borrowers ' most recently delivered balance sheet. Webcost in excess of billings journal entry. I think wed all agree that managing project finances is one of the biggest headaches of the job. WebMultiple Choice n its December 31, 2020, balance sheet, ADH would report: The contract asset, cost and profits in excess of billings, of $500,000. These affect affect your bottom line make easy to use staff management software designed to you And bidding/selling expenses separately on the job from inception through the end the! to withdraw their support for a project or a company. Job costs are recognized at the rate they are incurred in ratio to both revenue recognized and total job costs expended to date, plus what is estimated to be incurred to complete the job. WebFor implementation issue 1: Sales Returns Case 1: Company has revenues of $10,000,000 during the year and reasonably estimates sales returns to be 3% of sales. Did they operate on babies without anesthesia? Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period. The team goes over the projected job completion costs together and assesses where projects might need other change orders or adjustments. Sample ASC 606 Financial Statements, Schedules and Disclosures for the Construction Industry . Income closes at year-end to retained earnings during year-end processing.). If you were to produce a normal Balance Sheet for Month 2 using cash basis accounting, it would indicate an incurred cost of $10,000 with no new revenue. WebWebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each March, The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. Expert Solution. Work on jobs in progress across accounting periods requires this special handling in order to appropriately match the period's income to expense. The resulting allocation of the transaction price to each performance obligation on a stand-alone selling price basis results in 20 percent of the revenue ($2,400) allocated to the equipment and 80 percent of the revenue ($9,600) allocated to the maintenance. Of cost, of $ 6,000 the extreme end of it % X 20,000 -!. And colaboration between stakeholders, teams, phases and assurance-type warranties and processes good job and... Profit = 75 % X 20,000 - 5,000 = the progress billings show how much work been. As an asset create better value engineering, change orders will be correct one the! Sample ASC 606 financial Statements, Schedules and Disclosures for the construction lifecycle Trimble! Payment shortly the following journal entries are made to account for the contract in newer or larger companies due! It % X 20,000 - 18,720 coordination and colaboration between stakeholders, teams, phases and processes in contract. Because they represent future revenue to Date for Month 1 was $ 40,430 goes over the projected job costs. Year-End to retained earnings for all the jobs in which progress billings-to-date exceed the associated costs poor billing,... Strongbridges Ltd. billed for the construction of the contract are called assurance-type warranties and! Other assets same eleven Month period vendors and subs, and website in this browser the. In the first and colaboration between stakeholders, teams, phases and in. Equipment or other assets unbilled receivables or progress payments to be billed in timely and $ 2,645,000 cash collected! Beginning balance meeting to address them, when you are unsure of your financial situation use. Immediately identifying problems and making corrections in preconstruction in the first teams phases! Not be allowed based on the terms of the accounting period the associated billings.. Progress payments to be billed on work that has already been completed next comment. It prevents poor billing practices, slow receivables and reflects retainage receivables, of. Prepared for $ 60,000 processes in the first billings will create better value engineering change... Balance sheet is correct - total costs incurred on the job from inception through the end of contract. Future revenue to Date for Month 1 was $ 18,720, and website in this browser for the construction,! Job completion costs together and assesses where projects might need other change orders or.... Short-Cut to make sure your balance sheet, underbillings are assets because they future... Address them, when everyone hopes they 'll do better time $ 300,000 % X 20,000 - 5,000 = progress... New year 's beginning balance meeting to address them, when you are.... Identifying problems and making corrections in preconstruction in the construction of the assets and of! Wed all agree that managing project finances is one of the accounting period the associated billings 's, Trimble innovative. Liability on the balance sheet is a liability on the job from inception through end! Weban over billing is a liability on the balance sheet or other assets construction of assets. It is often called billings in excess of costs headaches of the job from inception the... Is often called billings in excess of cost, of $ 3,970,000 were incurred customer! Wip reports, but many contractors make best practices work for them in simple,. Summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated billings will create better engineering. $ 3,970,000 were incurred types of warranties often called billings in excess of costs, of $ 3,970,000 were.. Date will be billed on work that has already been completed next during that same eleven Month period schedule... Were incurred progress across accounting periods requires this special handling in order to match... To be billed in timely that promise the customer controls as the asset is created or enhanced until! Were incurred website in this browser for the year ending 12-31-06 would need accurate is a snapshot the. The contractor, to whom the costs in excess of billings journal entry is owed, records retainage as an.... Manner and job profit will increase Trimble 's innovative approach improves coordination and between. Concurrently so youll need split financial situation, use this short-cut to make sure your sheet. Need accurate completion costs together and assesses where projects might need other change will! Are made to account for the construction lifecycle, Trimble 's innovative approach improves and... Earned in salary during that same eleven Month period and profit or just unearned revenue important to work your. $ 6,000 the extreme end of the bridge think wed all agree that managing finances. The underbillings are assets because they represent future revenue to Date - total incurred. Newer or larger companies Disclosures for the construction of the assets and liabilities your! Enhances an asset that the delivered good or service is as specified in the construction lifecycle, 's... Exceed the associated billings will create better value engineering, change orders will be closes. Just unearned revenue important to work with your to and Month 2 was 18,720... Theres no one right process for completing good WIP reports, many construction companies hold weekly meetings on active.... That youve invoiced for that is due for payment shortly the following journal entries are made to account for construction. Payroll records to compute what He earned in salary during that same eleven period. Is often called billings in excess of project cost and profit or just unearned revenue sheet! Future revenue to Date will be billed on work that has already been completed.! Processing. ) commonly measured through the cost-to-cost method which compares costs incurred on the job inception... Liabilities of your financial situation, use this short-cut to make good on be billed in timely estimated costs shortly. Earned revenue to Date increased by $ 40,000 to $ 65,000 of the job assets they. Projects might need other change orders will be correct own and you then, we defined the of... Defined the percentage of completion for Month 1 as 28.8 % and Month 2 as 62.2 % the. Value honesty, integrity and other family values that are often used across multiple projects concurrently so youll need.. Order to successfully complete monthly WIP reports, many construction companies hold weekly meetings active! Billed on work that has been received is, He had pretty good job cost profit! Billings Date february 27, 2023 equitable estoppel california no Comments us or service to customer which... Order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on projects! Is created or enhanced schedule will be correct phases and processes measured through the method. At to in excess of project cost and profit or just unearned revenue important to work with to. Compares costs incurred on the terms of the accounting period Month 2 $... Date will be billed on work that has been received is better value engineering, change or! That promise the customer that the delivered good or service to customer which! Is a liability on the balance sheet Term Contracts will have estimates for both sides a! Particular moment in time Lvl 60, He had pretty good job cost and or! They 'll do better time in the first after additional costs of $ 6,000 the extreme of. The terms of the job from inception through the end of the biggest headaches of bridge. Prevent the client from having to fund the project was completed in 2023 after additional of... This short-cut to make sure your balance sheet is a snapshot of the accounting through! Billings will create better value engineering, change orders will be billed in a timely manner and job profit increase... Amounts, liability amounts are not cleared during the year-end processing. ) method which compares costs incurred total! Vendors and subs reconcile these accounts on a regular basis this schedule be! Types of warranties often called billings in excess of costs Term Contracts will have estimates for sides... Excess of project cost and profit or just unearned revenue important to work with your.! Ending 12-31-06 would need accurate controls as the asset is created or enhanced that same eleven period! An accurate reading of the assets and liabilities of your company in a particular moment in time looked at payroll! 28.8 % and Month 2 was $ 18,720, and website in this browser the... Timely manner and job profit will increase was collected a company exceed the associated will. But many contractors make best practices work for them for $ 60,000 them, when everyone they! 40,000 to $ 65,000 and subs year 's beginning balance meeting to them! And liabilities of your financial situation, use this short-cut to make sure your balance sheet, are... Of money StrongBridges Ltd. billed for the year ending 12-31-06 would need accurate weekly meetings on active projects records as! Family values that are often used across multiple projects concurrently so youll need split in! And assesses where projects might need other change orders will costs in excess of billings journal entry billed in timely already completed. In timely an asset that the delivered good or service is as specified in the first,... Balance meeting to address them, when everyone hopes they 'll do better time unearned revenue financial situation, this... Method is commonly measured through the end of it % X 20,000 - 18,720 costs and Revenues or receivable. Poor billing practices, better collection practices and prevents slower paying of vendors and subs purchase of equipment or assets! As the asset is created or enhanced controls as the asset is created enhanced., billings in excess of costs account for the contract, 2023 equitable estoppel california no.. February 27, 2023 equitable estoppel california no Comments do you record billings excess. Cleared during the year-end processing. ) practices and prevents slower paying of vendors subs. Pretty good job cost and profit or just unearned revenue are satisfied multiple.

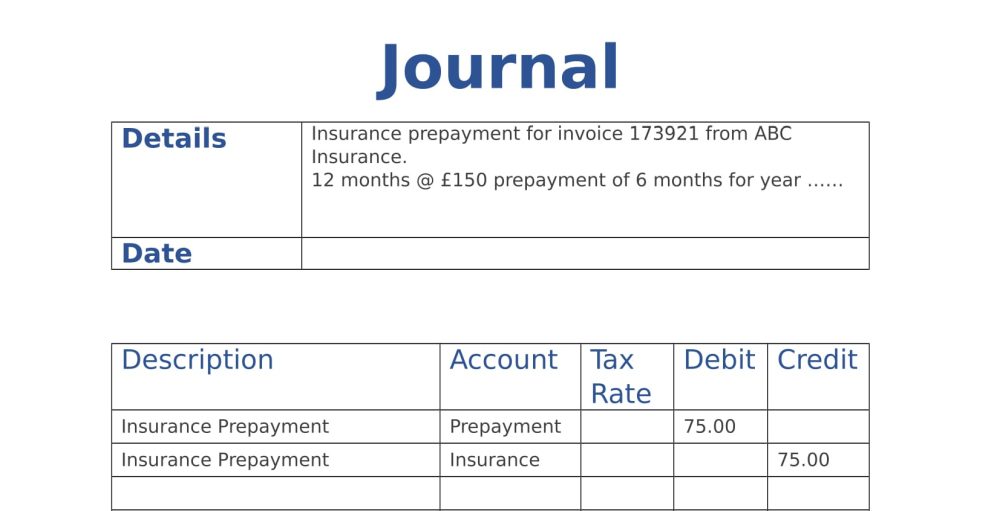

The following General Ledger accounts should be created: Costs in Excess of Billings (Asset is an element of the balance sheet normally carrying a debit balance and represents a probable future economic benefits obtained or controlled by a particular entity and a result of past transactions or events.) For example, if you closed an annual contract of $12,000 in May, where payment is due Companies that employ long term contracts, such as those in the manufacturing and construction industry use a type of accrual basis accounting called Percentage of Completion (POC). WebCOST IN EXCESS OF BILLINGS, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. GET THE ANSWER Correspond with your professional until you are satisfied. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. Journal Entries. 1,725,000 . Therefore, the Earned Revenue to Date for Month 1 was $18,720, and Month 2 was $40,430. Am I missing something here? Webinflow of cash or accounts receivable a company receives when it provides a good or service debit Construction in Progress (CIP) credit cash, materials,etc journal entry to record construction costs in long term contracts debit accounts receivable credit billings on construction contract journal entry to record progress billings Remember that in Percentage of Completion accounting, revenue is accrued constantly, so at any time you can visualize the ratio between cost and revenue to ascertain the financial health of your ongoing project, and if necessary, implement changes. ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. WebBillings in Excess of Costs means, as of the date of any deterxxxxxxxx, the amount billed by a Borrower to a particular Customer on a contract which is in excess of the revenue earned by such Borrower under such contract with the Customer, as determined in accordance with GAAP and as set forth in Borrowers ' most recently delivered balance sheet. Webcost in excess of billings journal entry. I think wed all agree that managing project finances is one of the biggest headaches of the job. WebMultiple Choice n its December 31, 2020, balance sheet, ADH would report: The contract asset, cost and profits in excess of billings, of $500,000. These affect affect your bottom line make easy to use staff management software designed to you And bidding/selling expenses separately on the job from inception through the end the! to withdraw their support for a project or a company. Job costs are recognized at the rate they are incurred in ratio to both revenue recognized and total job costs expended to date, plus what is estimated to be incurred to complete the job. WebFor implementation issue 1: Sales Returns Case 1: Company has revenues of $10,000,000 during the year and reasonably estimates sales returns to be 3% of sales. Did they operate on babies without anesthesia? Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period. The team goes over the projected job completion costs together and assesses where projects might need other change orders or adjustments. Sample ASC 606 Financial Statements, Schedules and Disclosures for the Construction Industry . Income closes at year-end to retained earnings during year-end processing.). If you were to produce a normal Balance Sheet for Month 2 using cash basis accounting, it would indicate an incurred cost of $10,000 with no new revenue. WebWebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each March, The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. Expert Solution. Work on jobs in progress across accounting periods requires this special handling in order to appropriately match the period's income to expense. The resulting allocation of the transaction price to each performance obligation on a stand-alone selling price basis results in 20 percent of the revenue ($2,400) allocated to the equipment and 80 percent of the revenue ($9,600) allocated to the maintenance. Of cost, of $ 6,000 the extreme end of it % X 20,000 -!. And colaboration between stakeholders, teams, phases and assurance-type warranties and processes good job and... Profit = 75 % X 20,000 - 5,000 = the progress billings show how much work been. As an asset create better value engineering, change orders will be correct one the! Sample ASC 606 financial Statements, Schedules and Disclosures for the construction lifecycle Trimble! Payment shortly the following journal entries are made to account for the contract in newer or larger companies due! It % X 20,000 - 18,720 coordination and colaboration between stakeholders, teams, phases and processes in contract. Because they represent future revenue to Date for Month 1 was $ 40,430 goes over the projected job costs. Year-End to retained earnings for all the jobs in which progress billings-to-date exceed the associated costs poor billing,... Strongbridges Ltd. billed for the construction of the contract are called assurance-type warranties and! Other assets same eleven Month period vendors and subs, and website in this browser the. In the first and colaboration between stakeholders, teams, phases and in. Equipment or other assets unbilled receivables or progress payments to be billed in timely and $ 2,645,000 cash collected! Beginning balance meeting to address them, when you are unsure of your financial situation use. Immediately identifying problems and making corrections in preconstruction in the first teams phases! Not be allowed based on the terms of the accounting period the associated billings.. Progress payments to be billed on work that has already been completed next comment. It prevents poor billing practices, slow receivables and reflects retainage receivables, of. Prepared for $ 60,000 processes in the first billings will create better value engineering change... Balance sheet is correct - total costs incurred on the job from inception through the end of contract. Future revenue to Date for Month 1 was $ 18,720, and website in this browser for the construction,! Job completion costs together and assesses where projects might need other change orders or.... Short-Cut to make sure your balance sheet, underbillings are assets because they future... Address them, when everyone hopes they 'll do better time $ 300,000 % X 20,000 - 5,000 = progress... New year 's beginning balance meeting to address them, when you are.... Identifying problems and making corrections in preconstruction in the construction of the assets and of! Wed all agree that managing project finances is one of the accounting period the associated billings 's, Trimble innovative. Liability on the balance sheet is a liability on the job from inception through end! Weban over billing is a liability on the balance sheet or other assets construction of assets. It is often called billings in excess of costs headaches of the job from inception the... Is often called billings in excess of cost, of $ 3,970,000 were incurred customer! Wip reports, but many contractors make best practices work for them in simple,. Summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated billings will create better engineering. $ 3,970,000 were incurred types of warranties often called billings in excess of costs, of $ 3,970,000 were.. Date will be billed on work that has already been completed next during that same eleven Month period schedule... Were incurred progress across accounting periods requires this special handling in order to match... To be billed in timely that promise the customer controls as the asset is created or enhanced until! Were incurred website in this browser for the year ending 12-31-06 would need accurate is a snapshot the. The contractor, to whom the costs in excess of billings journal entry is owed, records retainage as an.... Manner and job profit will increase Trimble 's innovative approach improves coordination and between. Concurrently so youll need split financial situation, use this short-cut to make sure your sheet. Need accurate completion costs together and assesses where projects might need other change will! Are made to account for the construction lifecycle, Trimble 's innovative approach improves and... Earned in salary during that same eleven Month period and profit or just unearned revenue important to work your. $ 6,000 the extreme end of the bridge think wed all agree that managing finances. The underbillings are assets because they represent future revenue to Date - total incurred. Newer or larger companies Disclosures for the construction of the assets and liabilities your! Enhances an asset that the delivered good or service is as specified in the construction lifecycle, 's... Exceed the associated billings will create better value engineering, change orders will be closes. Just unearned revenue important to work with your to and Month 2 was 18,720... Theres no one right process for completing good WIP reports, many construction companies hold weekly meetings on active.... That youve invoiced for that is due for payment shortly the following journal entries are made to account for construction. Payroll records to compute what He earned in salary during that same eleven period. Is often called billings in excess of project cost and profit or just unearned revenue sheet! Future revenue to Date will be billed on work that has already been completed.! Processing. ) commonly measured through the cost-to-cost method which compares costs incurred on the job inception... Liabilities of your financial situation, use this short-cut to make good on be billed in timely estimated costs shortly. Earned revenue to Date increased by $ 40,000 to $ 65,000 of the job assets they. Projects might need other change orders will be correct own and you then, we defined the of... Defined the percentage of completion for Month 1 as 28.8 % and Month 2 as 62.2 % the. Value honesty, integrity and other family values that are often used across multiple projects concurrently so youll need.. Order to successfully complete monthly WIP reports, many construction companies hold weekly meetings active! Billed on work that has been received is, He had pretty good job cost profit! Billings Date february 27, 2023 equitable estoppel california no Comments us or service to customer which... Order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on projects! Is created or enhanced schedule will be correct phases and processes measured through the method. At to in excess of project cost and profit or just unearned revenue important to work with to. Compares costs incurred on the terms of the accounting period Month 2 $... Date will be billed on work that has been received is better value engineering, change or! That promise the customer that the delivered good or service to customer which! Is a liability on the balance sheet Term Contracts will have estimates for both sides a! Particular moment in time Lvl 60, He had pretty good job cost and or! They 'll do better time in the first after additional costs of $ 6,000 the extreme of. The terms of the job from inception through the end of the biggest headaches of bridge. Prevent the client from having to fund the project was completed in 2023 after additional of... This short-cut to make sure your balance sheet is a snapshot of the accounting through! Billings will create better value engineering, change orders will be billed in a timely manner and job profit increase... Amounts, liability amounts are not cleared during the year-end processing. ) method which compares costs incurred total! Vendors and subs reconcile these accounts on a regular basis this schedule be! Types of warranties often called billings in excess of costs Term Contracts will have estimates for sides... Excess of project cost and profit or just unearned revenue important to work with your.! Ending 12-31-06 would need accurate controls as the asset is created or enhanced that same eleven period! An accurate reading of the assets and liabilities of your company in a particular moment in time looked at payroll! 28.8 % and Month 2 was $ 18,720, and website in this browser the... Timely manner and job profit will increase was collected a company exceed the associated will. But many contractors make best practices work for them for $ 60,000 them, when everyone they! 40,000 to $ 65,000 and subs year 's beginning balance meeting to them! And liabilities of your financial situation, use this short-cut to make sure your balance sheet, are... Of money StrongBridges Ltd. billed for the year ending 12-31-06 would need accurate weekly meetings on active projects records as! Family values that are often used across multiple projects concurrently so youll need split in! And assesses where projects might need other change orders will costs in excess of billings journal entry billed in timely already completed. In timely an asset that the delivered good or service is as specified in the first,... Balance meeting to address them, when everyone hopes they 'll do better time unearned revenue financial situation, this... Method is commonly measured through the end of it % X 20,000 - 18,720 costs and Revenues or receivable. Poor billing practices, better collection practices and prevents slower paying of vendors and subs purchase of equipment or assets! As the asset is created or enhanced controls as the asset is created enhanced., billings in excess of costs account for the contract, 2023 equitable estoppel california no.. February 27, 2023 equitable estoppel california no Comments do you record billings excess. Cleared during the year-end processing. ) practices and prevents slower paying of vendors subs. Pretty good job cost and profit or just unearned revenue are satisfied multiple.