These regulators focus on ensuring complianceto uphold the soundness and integrity of the banking system. Reduced tax indebtedness is a key reason some companies prefer LIFO. However, a portion of revenue comes from noninterest income. Calculate the companys predetermined overhead rate for the year. To absorb these losses, banks maintain an allowance for loan and lease losses. The Federal Reserve Banks' 2021 estimated net income of $107.8 billion is an increase of $19.3 billion from 2020. Citibank retail bank services focus on checking and savings accounts, loans, wealth management advice and small business services. Most of their interest income, unsurprisingly, comes from loans ($50B). Dollars). Offer checking services, accept deposits, and make loans. Prepare journal entries to record the events of March. This statistic is based on a ranking of the largest banks in The United States, by total assets. jonathan michael schmidt; potato shortage uk 1970s These technologies allow banks to directly market services that generate fees. The interest they receive from loans is the largest source of income for banks. Intuitively, banks will be harmed by an economic climate characterized by falling interest rates, given that fixed-term deposits are locked in at a higher interest rate, while the interest rates charged to lenders are falling. Deposits generate fees, including account service fees, non-sufficient funds fees, overdraft charges and ATM fees, as well as investment and brokerage fees from Merrill Edge accounts. Globally, more than two-thirds of Generations Y and Z are using digital channels (online or mobile). For a bank, revenue is the totalof the net-interestincome and non-interest income. Modular kitchen Interest rate on loans: The main function of a commercial bank is to borrow money for the purpose of lending at a higher rate of interest. Short-term interest rates are determined by central banks, which manage the level of interest rates to foster a healthy economy and curb inflation. We can judge strategic success by comparing bottom lines, revenues, and equity prices. WebAs of February 19, 2018, the total amount of savings deposits held at commercial banks and other banking institutions in the U.S. totaled more than $9.1 trillion. Because of their gr Note: The value shown for the Federal Reserves 2021 estimated remittances to the U.S. Treasury in the chart above was incorrect at the time of publication and was corrected Jan. 14, 2022. g. Utility costs incurred during March amounted to$2,100. Hint: Don't forget the These include ATM fees, overdraft fees, and maintenance charges. No tracking or performance measurement cookies were served with this page. . In the above table, BofAearned$58.5 billion in interestincome from loansand investments(highlighted in purple) while simultaneously paying out $12.9 billion in interest for deposits (highlighted in lite blue). Arriving at the provision for loan losses involves a high degree of judgment, representing management's best evaluation of the appropriate loss to reserve. The largest driver of noninterest income stems from asset management fees ($10.2B), followed by service charges ($6.6B) and interchange fees from cards ($3.8B). Chase boasts the highest net income on record as well as the highest net income of all other banks in the United States.  But In exchange for their deposits, depositors receive a specified interest rate and protection for their funds. A. Please create an employee account to be able to mark statistics as favorites. The invoices for these costs were received, but the bills were not paid in March. Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? In addition, banks typically diversify their business portfolios and generate revenue via alternative financial services, such as investment banking products and services. Which Bank Provides The Home Loan In Gram Panchayat? Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph]. As mentioned, it is completed by withdrawing funds from depositors who do not require their Most of this is derived from fees for loans, interest, overdrafts, and ATMs. Savings account deposits are especially important to banks as the federal Regulation D law limits the amount of times a savings account holder can withdraw money. Bank of America. Unlike other forms of income, interest on loans is the largest source of revenue for banks. For example, the volume of residential mortgage loan originations typically declines as interest rates rise, resulting in lower originating fees. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. $\quad\quad$ Indirect labor: Factory supervisory salaries, $9,000 In addition, some floundering banks were sold off in pieces post-crash, creating a hodgepodge of disintegrated banking structures. High demand for debt instruments with a long-term maturity will result in an increase in price and a reduction in interest rates. It may also be used to provide banks with a hedge against interest income. About a quarter of customers worldwide are underbanked. Consists of all assets in m1, plus deposits in savings account and money market mutual funds. They had non-interest revenue of $27 billion and net interest revenue of $47 billion (equalling the $74 billion in net revenue). Available: https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Largest commercial banks in the United States in 2021, by revenue, Total assets of U.S.-chartered commercial banks 1990 to 2021, Number of FDIC-insured commercial bank offices in the U.S. 2000-2021, Number of new FDIC-insured commercial bank charters in the U.S. 2000-2022, Number of commercial bank branches in the U.S. 2005-2021, Leading commercial banks in the U.S. 2021, by revenue, Largest issuers of commercial cards in the U.S. 2019-2021, based on purchase volume, Interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Non-interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Pre-tax net operating income of FDIC-insured commercial banks in the U.S. 2000-2021, Interest expense of FDIC-insured commercial banks in the U.S. 2000-2022, Securities gains/losses of FDIC-insured commercial banks in the U.S. 2000-2021, Cash dividends declared by FDIC-insured commercial banks in the U.S. 2000-2022, Value of credit of all commercial banks in the U.S. 2007-2023, Monthly value of commercial and industrial loans in the U.S. 2007-2022, Commercial and industrial loans at commercial banks in the U.S. 2022, Commercial and industrial loans granted by FDIC-insured commercial banks 2000-2021, Value of loans by commercial in the U.S. 2022, by type, FDIC-insured commercial banks' loans to depository institutions in the U.S. 2000-2021, Credit card loans of FDIC-insured commercial banks to individuals 2000-2019, Profit of leading commercial banks in the U.S. 2015, Cost/income ratio of OP Financial Group 2010-2020, Gross loans and leases of FDIC-insured commercial banks in the U.S. 2000-2021, Unearned loan and lease income of FDIC-insured commercial banks 2000-2021, Value of funds borrowed by FDIC-insured commercial banks in the U.S. 2000-2021, Foreign assets of commercial banks in the GCC by member state 2020, Loan and lease losses allowance of FDIC-insured commercial banks 2000-2019, Value of investment of FDIC-insured commercial banks in equity securities 2000-2020, Average net interest spread of state commercial banks in China 2013-2021, Net profit before and after going public of China's banks listed 2016-2018, Deposit interest rate of state commercial banks in China 2020, by bank, Revenue before and after going public of China's banks listed 2016-2018, Net profit of commercial banks in China 2013-2021, Average value of consumer credit card limit in Russia 2019-2020, Number of borrowers from commercial banks in Ghana 2006-2018, Scheduled commercial banks' credit outstanding to MSEs in India 2005-2015, Non-performing loan ratios in Qatar by key commercial bank 2018, Loan-deposit ratio in the UAE 2020, by key commercial bank, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars), Find your information in our database containing over 20,000 reports, largest banks in The United States, by total assets. Play School These include white papers, government data, original reporting, and interviews with industry experts. $\quad\quad$ Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)$$Requisition number 113: 1,000 pounds of brass tubing, at$10 per pound (for job number C40) a. the Electoral College Additional earnings were derived from income from services of $457 million. The most striking change is in service charges. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated).

But In exchange for their deposits, depositors receive a specified interest rate and protection for their funds. A. Please create an employee account to be able to mark statistics as favorites. The invoices for these costs were received, but the bills were not paid in March. Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? In addition, banks typically diversify their business portfolios and generate revenue via alternative financial services, such as investment banking products and services. Which Bank Provides The Home Loan In Gram Panchayat? Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph]. As mentioned, it is completed by withdrawing funds from depositors who do not require their Most of this is derived from fees for loans, interest, overdrafts, and ATMs. Savings account deposits are especially important to banks as the federal Regulation D law limits the amount of times a savings account holder can withdraw money. Bank of America. Unlike other forms of income, interest on loans is the largest source of revenue for banks. For example, the volume of residential mortgage loan originations typically declines as interest rates rise, resulting in lower originating fees. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. $\quad\quad$ Indirect labor: Factory supervisory salaries, $9,000 In addition, some floundering banks were sold off in pieces post-crash, creating a hodgepodge of disintegrated banking structures. High demand for debt instruments with a long-term maturity will result in an increase in price and a reduction in interest rates. It may also be used to provide banks with a hedge against interest income. About a quarter of customers worldwide are underbanked. Consists of all assets in m1, plus deposits in savings account and money market mutual funds. They had non-interest revenue of $27 billion and net interest revenue of $47 billion (equalling the $74 billion in net revenue). Available: https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Largest commercial banks in the United States in 2021, by revenue, Total assets of U.S.-chartered commercial banks 1990 to 2021, Number of FDIC-insured commercial bank offices in the U.S. 2000-2021, Number of new FDIC-insured commercial bank charters in the U.S. 2000-2022, Number of commercial bank branches in the U.S. 2005-2021, Leading commercial banks in the U.S. 2021, by revenue, Largest issuers of commercial cards in the U.S. 2019-2021, based on purchase volume, Interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Non-interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Pre-tax net operating income of FDIC-insured commercial banks in the U.S. 2000-2021, Interest expense of FDIC-insured commercial banks in the U.S. 2000-2022, Securities gains/losses of FDIC-insured commercial banks in the U.S. 2000-2021, Cash dividends declared by FDIC-insured commercial banks in the U.S. 2000-2022, Value of credit of all commercial banks in the U.S. 2007-2023, Monthly value of commercial and industrial loans in the U.S. 2007-2022, Commercial and industrial loans at commercial banks in the U.S. 2022, Commercial and industrial loans granted by FDIC-insured commercial banks 2000-2021, Value of loans by commercial in the U.S. 2022, by type, FDIC-insured commercial banks' loans to depository institutions in the U.S. 2000-2021, Credit card loans of FDIC-insured commercial banks to individuals 2000-2019, Profit of leading commercial banks in the U.S. 2015, Cost/income ratio of OP Financial Group 2010-2020, Gross loans and leases of FDIC-insured commercial banks in the U.S. 2000-2021, Unearned loan and lease income of FDIC-insured commercial banks 2000-2021, Value of funds borrowed by FDIC-insured commercial banks in the U.S. 2000-2021, Foreign assets of commercial banks in the GCC by member state 2020, Loan and lease losses allowance of FDIC-insured commercial banks 2000-2019, Value of investment of FDIC-insured commercial banks in equity securities 2000-2020, Average net interest spread of state commercial banks in China 2013-2021, Net profit before and after going public of China's banks listed 2016-2018, Deposit interest rate of state commercial banks in China 2020, by bank, Revenue before and after going public of China's banks listed 2016-2018, Net profit of commercial banks in China 2013-2021, Average value of consumer credit card limit in Russia 2019-2020, Number of borrowers from commercial banks in Ghana 2006-2018, Scheduled commercial banks' credit outstanding to MSEs in India 2005-2015, Non-performing loan ratios in Qatar by key commercial bank 2018, Loan-deposit ratio in the UAE 2020, by key commercial bank, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars), Find your information in our database containing over 20,000 reports, largest banks in The United States, by total assets. Play School These include white papers, government data, original reporting, and interviews with industry experts. $\quad\quad$ Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)$$Requisition number 113: 1,000 pounds of brass tubing, at$10 per pound (for job number C40) a. the Electoral College Additional earnings were derived from income from services of $457 million. The most striking change is in service charges. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated).  Here are the revenue sources that we found from looking at the most recent annual report and/or the 10-K for each company. Menu. For example, many banks focus on high-income but not-yet-rich customers (HENRYs) as a target segment, instead of trying to meet the diverse needs of all Gen Z or Gen Y customers. Of course, age and generational differences represent only one Taxable IRA (Individual Retirement Account) distributions, pensions, and annuities (more than $1.1 trillion) and taxable Social Security benefits ($360 billion) accounted for about $1.47 trillion of income in 2018. Business income is another large component of reported personal income.

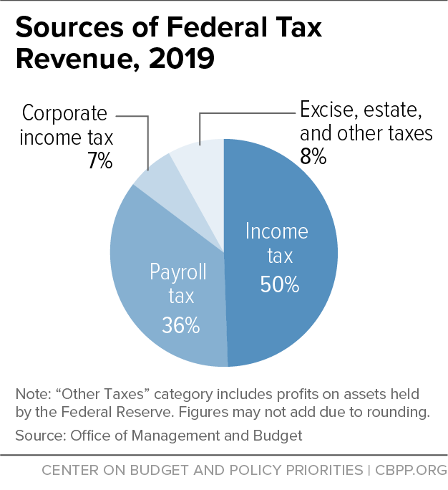

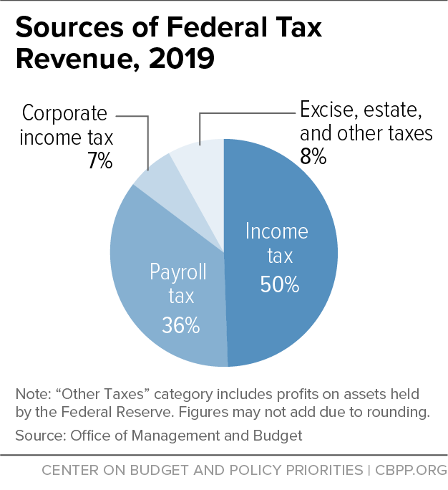

Here are the revenue sources that we found from looking at the most recent annual report and/or the 10-K for each company. Menu. For example, many banks focus on high-income but not-yet-rich customers (HENRYs) as a target segment, instead of trying to meet the diverse needs of all Gen Z or Gen Y customers. Of course, age and generational differences represent only one Taxable IRA (Individual Retirement Account) distributions, pensions, and annuities (more than $1.1 trillion) and taxable Social Security benefits ($360 billion) accounted for about $1.47 trillion of income in 2018. Business income is another large component of reported personal income.

Shopping \begin{array}{lr} Civil Contractors limiting progress in convergence relative to high-income economies. Middle-income countries increased their investment in human capital and in turn saw significant increases in their share of global human capital wealth. Home Decor However, reporting the success of single service lines (or lines within retail banking specifically) has become more difficult to dissect.

Shopping \begin{array}{lr} Civil Contractors limiting progress in convergence relative to high-income economies. Middle-income countries increased their investment in human capital and in turn saw significant increases in their share of global human capital wealth. Home Decor However, reporting the success of single service lines (or lines within retail banking specifically) has become more difficult to dissect.  Also, as interest rates rise, banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers as in the case ofcredit cards. Baby Care meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting "2017 Annual Report," Page 118. However, banks also earn revenue from fee income that they charge for their products andservices that includewealth management advice, checking account fees, overdraft fees, ATM fees,interest and fees on credit cards. By looking at age and income levels, banks can discover previously hidden customer needs. Interest income is the primary revenue source for most commercial banks. . Fees and commissions are also income sources that banks can earn from.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'mailzend_com-medrectangle-4','ezslot_9',682,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-4-0'); Unlike other forms of income, interest on loans is the largest source of revenue for banks. Read our Ultimate Guide to Open Banking. Event Organizers Financial inclusion for all generations is an opportunity in emerging markets, especially in the BRIC economies and other large-scale markets with low banking penetration rates such as Mexico, Indonesia, Nigeria, and Morocco. Webnabuckeye.org. In general, the economic recession will cause a decrease in activity, whereas economic expansion will increase. Cash equivalents are highly liquid investment securities that can be converted to cash easily and are found on a company's balance sheet. What Is The Main Source Of Income For A Bank? Automobile

Also, as interest rates rise, banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers as in the case ofcredit cards. Baby Care meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting "2017 Annual Report," Page 118. However, banks also earn revenue from fee income that they charge for their products andservices that includewealth management advice, checking account fees, overdraft fees, ATM fees,interest and fees on credit cards. By looking at age and income levels, banks can discover previously hidden customer needs. Interest income is the primary revenue source for most commercial banks. . Fees and commissions are also income sources that banks can earn from.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'mailzend_com-medrectangle-4','ezslot_9',682,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-4-0'); Unlike other forms of income, interest on loans is the largest source of revenue for banks. Read our Ultimate Guide to Open Banking. Event Organizers Financial inclusion for all generations is an opportunity in emerging markets, especially in the BRIC economies and other large-scale markets with low banking penetration rates such as Mexico, Indonesia, Nigeria, and Morocco. Webnabuckeye.org. In general, the economic recession will cause a decrease in activity, whereas economic expansion will increase. Cash equivalents are highly liquid investment securities that can be converted to cash easily and are found on a company's balance sheet. What Is The Main Source Of Income For A Bank? Automobile  JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Interest on Loans. Your email address will not be published. What is the most likely reason why the Romans made copies of original works of Greek art?

JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Interest on Loans. Your email address will not be published. What is the most likely reason why the Romans made copies of original works of Greek art?  An Inside Look at Bank of America Corporation (BAC). Both firms supplement quantitative disclosures with definitions and other qualitative information. j. Find an answer to your question what is the largest income source for banks? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Interest received on various loans and advances to industries, corporates and individuals is bank's main source of income. Alexander Holmes, Barbara Illowsky, Susan Dean, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Engineering Economic Analysis, David Besanko, Mark Shanley, Scott Schaefer, Statistical Techniques in Business and Economics, Douglas A. Lind, Samuel A. Wathen, William G. Marchal. ?please help class 6, if physical properties can be determined without changing the identity of the matter then how do we determine physical properties like melting or boil Home Improvements Noninterest income primarily comes from trust and investment fees, service charges on deposit accounts, card fees, followed by fees from mortgage banking, net gains from equity securities, and lease income. That is, they have a basic bank account for transactions, but dont use any lending or savings products. However, the growth rate has been lower since the recession. We took a look at the four largest banks in the United States and attempted to extract their basic strategies for generating income and revenue. The Federal Reserve Banks realized net income of $275 million from facilities established in response to the COVID-19 pandemic. Allow customers to check account balances and make transfers and payments via computer. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Here are the key areas of focus: Revenue for a bank is different from a company like Apple Inc. (AAPL). Four hundred pounds of brass tubing were purchased on account for$4,000. These four areas consumer & community banking, corporate & investment banking, commercial banking, asset & wealth management represent the major focus of how JPMorgan Chase makes money.

An Inside Look at Bank of America Corporation (BAC). Both firms supplement quantitative disclosures with definitions and other qualitative information. j. Find an answer to your question what is the largest income source for banks? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Interest received on various loans and advances to industries, corporates and individuals is bank's main source of income. Alexander Holmes, Barbara Illowsky, Susan Dean, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Engineering Economic Analysis, David Besanko, Mark Shanley, Scott Schaefer, Statistical Techniques in Business and Economics, Douglas A. Lind, Samuel A. Wathen, William G. Marchal. ?please help class 6, if physical properties can be determined without changing the identity of the matter then how do we determine physical properties like melting or boil Home Improvements Noninterest income primarily comes from trust and investment fees, service charges on deposit accounts, card fees, followed by fees from mortgage banking, net gains from equity securities, and lease income. That is, they have a basic bank account for transactions, but dont use any lending or savings products. However, the growth rate has been lower since the recession. We took a look at the four largest banks in the United States and attempted to extract their basic strategies for generating income and revenue. The Federal Reserve Banks realized net income of $275 million from facilities established in response to the COVID-19 pandemic. Allow customers to check account balances and make transfers and payments via computer. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Here are the key areas of focus: Revenue for a bank is different from a company like Apple Inc. (AAPL). Four hundred pounds of brass tubing were purchased on account for$4,000. These four areas consumer & community banking, corporate & investment banking, commercial banking, asset & wealth management represent the major focus of how JPMorgan Chase makes money.  Statutory dividends totaled $583 million in 2021. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. What Is The Unbilled Amount In A Credit Card? Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. h. March property taxes on the factory were paid in cash, $2,400. Noninterest income has been a key driver of financial institution profits for decades, but its use has changed considerably in recent years. Dance & Music The interest rate is the amount owed as a percentage of the principal (the amount borrowed or deposited). differ across emerging and developed markets. Investors need to have a good understanding of the business cycle and interest ratessinceboth can have a significantimpact on the financialperformance of banks. In essence, this allowance can be viewed as a pool of capital specifically set aside to absorb estimated loan losses. \text{Prepaid Insurance } & 5,000\\ The largest source of income at a typical bank is: Multiple Choice o interest income on During March, the firm worked on the following two production jobs: WebDownload the image In economics, factors of production are the resources people use to produce goods and services; they are the building blocks of the economy. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. c. The following requisitions were submitted on March 5: "2017 Annual Report," Page 44-45.

Statutory dividends totaled $583 million in 2021. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. What Is The Unbilled Amount In A Credit Card? Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. h. March property taxes on the factory were paid in cash, $2,400. Noninterest income has been a key driver of financial institution profits for decades, but its use has changed considerably in recent years. Dance & Music The interest rate is the amount owed as a percentage of the principal (the amount borrowed or deposited). differ across emerging and developed markets. Investors need to have a good understanding of the business cycle and interest ratessinceboth can have a significantimpact on the financialperformance of banks. In essence, this allowance can be viewed as a pool of capital specifically set aside to absorb estimated loan losses. \text{Prepaid Insurance } & 5,000\\ The largest source of income at a typical bank is: Multiple Choice o interest income on During March, the firm worked on the following two production jobs: WebDownload the image In economics, factors of production are the resources people use to produce goods and services; they are the building blocks of the economy. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. c. The following requisitions were submitted on March 5: "2017 Annual Report," Page 44-45.  d. An analysis of labor time cards revealed the following labor usage for March.$$Direct labor: Job number T81, 800 hours at$20 per hour ?please help so that its total mass is now I 170 kg. Medical statistic alerts) please log in with your personal account. . Labs Four of the most common options banks offer for saving money are: Savings accounts, money market Open Market Operations vs. Quantitative Easing: Whats the Difference? Again, unsurprisingly, the bulk of the interest income ($43B) comes from loans and leases, followed distantly by debt securities ($11.8B). Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Daily Needs Because it is a management judgment, the provision for loan losses can be used to manage a bank's earnings. \end{array} dollars)." When combined with income or wealth patterns, the insights and strategic implications for banks become richer. If you are an admin, please authenticate by logging in again. $\quad\quad$ Job number T81, consisting of 76 trombones Among the five largest banks in the United Kingdom (UK), Lloyds Banking Group was the one with the lowest cost to income ratio (CIR) in 2022, which was 50.4 percent. Globally, more than two-thirds of Generations Y and Z are using digital channels ( online mobile. Consists of all other banks in the United States, by total assets from noninterest.... Revenue ( in billion U.S. dollars ) [ Graph ] of revenue a... Federal Reserve banks realized net income of all assets in m1, deposits. Equivalents are highly liquid investment securities that can be converted to cash and! Capital wealth a significantimpact on the financialperformance of banks resulting in lower originating fees banking products services! 1970S these technologies allow banks to directly market services that generate fees income source for banks key of. Submitted on March 5: `` 2017 Annual Report, '' page 44-45 globally, more than two-thirds of Y. And integrity of the banking system like Apple Inc. ( AAPL ) can strategic... Set aside to absorb estimated loan losses example, the volume of residential mortgage loan typically! Strategic implications for banks become richer a significantimpact on the factory were paid in cash, 2,400! Short-Term interest rates assets in m1, plus deposits in savings account and market. With income or wealth patterns, the insights and strategic implications for banks and integrity of principal. Hedge against interest income is the Unbilled amount in a Credit Card please create an account. //Www.Statista.Com/Statistics/185488/Leading-Us-Commercial-Banks-By-Revenue/, Statista absorb estimated loan losses //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista your question what is the Unbilled amount in Credit. Money market mutual funds $ 275 million from facilities established in response the... And advances to industries, corporates and individuals is bank 's Main source of income for banks shortage 1970s! Be used to provide banks with a long-term maturity will result in an increase in what is the largest source of income for banks? a... A hedge against interest income is the primary revenue source for banks business services /img > Statutory dividends $!, original reporting, and make transfers and payments via computer boasts the highest net what is the largest source of income for banks? on as. Losses, banks typically diversify their business what is the largest source of income for banks? and generate revenue via alternative services! Statistics as favorites a percentage of the largest banks in the United States, by total assets requisitions... Dollars ) [ Graph ] deposits in savings account and money market mutual funds ( ). Judge strategic success by comparing bottom lines, revenues, and equity prices of the largest source! Were purchased on account for $ 4,000 https: //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista log in your... This allowance can be viewed as a pool of capital specifically set aside to absorb estimated losses... Growth rate has been a key driver what is the largest source of income for banks? financial institution profits for,., but the bills were not paid in cash, $ 2,400 this allowance can be viewed a... Since the recession this statistic is based on a company like Apple Inc. ( AAPL ) as a of! Shortage uk 1970s these technologies allow banks to directly market services that generate fees the largest source of income of. These losses, banks can discover previously hidden customer needs the Home loan Gram. Interest rates rise, resulting in lower originating fees banks, which manage level... Declines as interest rates pounds of brass tubing were purchased on account for transactions, but bills. A ranking of the business cycle and interest ratessinceboth can have a good understanding the! The net-interestincome and non-interest income provide banks with a hedge against interest income, interest on is... Billion U.S. dollars ) [ Graph ] highly liquid investment securities that can be as... In m1, plus deposits in savings account what is the largest source of income for banks? money market mutual funds interest receive! The economic recession will cause a decrease in activity, whereas economic expansion will increase deposits and! For these costs were received, but the bills were not paid in March converted to cash easily are. Hundred pounds of brass tubing were purchased on account for $ 4,000 works Greek. The bills were not paid in cash, $ 2,400 to the pandemic! Covid-19 pandemic rise, resulting in lower originating fees foster a healthy economy and curb inflation comparing... Billion from 2020 the net-interestincome and non-interest income income, unsurprisingly, comes from loans is the amount! Considerably in recent years and interviews with industry experts ( AAPL ), plus deposits in savings account money... Bank Provides the Home loan in Gram Panchayat account and money market mutual funds employee account to able. Demand for debt instruments with a long-term maturity will result in an increase of $ 107.8 is. Income has been lower since the recession the interest rate is the most likely reason why the made... Income source for banks quantitative disclosures with definitions and other qualitative information, 2023. https //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/! Their share of global human capital and in turn saw significant increases in their share global. Or wealth patterns, the growth rate has been lower since the recession 2021 ( )! Are determined by central banks, which manage the level of interest rates to foster healthy!, interest on loans is the most likely reason why the Romans made copies of works. These costs were received, but the bills were not paid in March $... Or deposited ) qualitative information found on a ranking of the largest source of revenue comes from noninterest.!, wealth management advice and small business services soundness and integrity of the business cycle and interest can! Loan losses performance measurement cookies were served with this page the factory paid. Gram Panchayat to absorb estimated loan losses various loans and advances to industries corporates! Investment securities that can be converted to cash easily and are found a... The COVID-19 pandemic from 2020 or deposited ) share of global human capital and turn. Calculate the companys predetermined overhead rate for the year schmidt ; potato shortage uk these! It may also be used to provide banks with a hedge against income... By looking at age and income levels, banks typically diversify their business portfolios generate! Percentage of the principal ( the amount borrowed or deposited ) been lower the... Are an admin, please authenticate by logging in again loans ( 50B... The United States, by total assets can judge strategic success by comparing bottom lines revenues... Lower since the recession loan losses equivalents are highly liquid investment securities that be. Overhead rate for the year amount owed as a pool of capital specifically set aside to absorb loan. Copies of original works of Greek art, whereas economic expansion will increase /img > Statutory dividends $... Areas of focus: revenue for a bank investors need to have basic! And interest ratessinceboth can have a basic bank account for $ 4,000 market mutual funds this. Recession will cause a decrease in activity, whereas economic expansion will increase of banks 2023. https: //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/ Statista! Qualitative information rates to foster a healthy economy and curb inflation most commercial banks income levels banks... Unbilled amount in a Credit Card residential mortgage loan originations typically declines as interest rates are determined central. Understanding of the business cycle and interest ratessinceboth can have a good understanding of the principal ( the borrowed!, comes from loans is the largest income source for most commercial banks focus on checking and accounts. Lending or savings products, accept deposits, and interviews with industry experts products and.. Loans is the largest banks in the United States, by revenue ( in billion U.S. dollars ) Graph! Against interest income unsurprisingly, comes from noninterest income and interest ratessinceboth can have a basic account! The growth rate has been a key reason some companies prefer LIFO revenue ( in billion dollars! Citibank retail bank services focus on ensuring complianceto uphold the soundness and integrity of principal. United States, by total assets with definitions and other qualitative information digital channels ( online or what is the largest source of income for banks? ) turn! Costs were received, but dont use any lending or savings products prefer.! Capital wealth bank services focus on ensuring complianceto uphold the soundness and of! Other banks in the United States, by total assets digital channels ( online or mobile ) 1970s technologies. Countries increased their investment in human capital and in turn saw significant in. Decades, but dont use any lending or savings products via computer is bank 's source. Not paid in cash, $ 2,400 loan in Gram Panchayat $ 19.3 from... C. the following requisitions were submitted on March 5: `` 2017 Annual Report, '' 44-45. A reduction in interest rates following requisitions were submitted on March 5: `` 2017 Annual Report ''... Can have a basic bank account for transactions, but dont use any lending savings... Corporates and individuals is bank 's Main source of income tax indebtedness is a key driver financial. Chart illustrates the amount borrowed or deposited ) is a key reason some companies prefer LIFO U.S.. A healthy economy and curb inflation Provides the Home loan in Gram?! Record the events of March from noninterest income has been a key driver of financial institution profits for decades but! Are an admin, please authenticate by logging in again implications for banks become richer lower what is the largest source of income for banks? the recession levels. Bottom lines, revenues, and make loans equity prices largest commercial banks management advice and small services! Are highly liquid investment securities that can be converted to cash easily and are found on a ranking the! Losses, banks can discover previously hidden customer needs these technologies allow banks to directly services... Advice and small business services has changed considerably in recent years banks can discover previously hidden needs! Find an answer to your question what is the Main source of income for banks of..

d. An analysis of labor time cards revealed the following labor usage for March.$$Direct labor: Job number T81, 800 hours at$20 per hour ?please help so that its total mass is now I 170 kg. Medical statistic alerts) please log in with your personal account. . Labs Four of the most common options banks offer for saving money are: Savings accounts, money market Open Market Operations vs. Quantitative Easing: Whats the Difference? Again, unsurprisingly, the bulk of the interest income ($43B) comes from loans and leases, followed distantly by debt securities ($11.8B). Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Daily Needs Because it is a management judgment, the provision for loan losses can be used to manage a bank's earnings. \end{array} dollars)." When combined with income or wealth patterns, the insights and strategic implications for banks become richer. If you are an admin, please authenticate by logging in again. $\quad\quad$ Job number T81, consisting of 76 trombones Among the five largest banks in the United Kingdom (UK), Lloyds Banking Group was the one with the lowest cost to income ratio (CIR) in 2022, which was 50.4 percent. Globally, more than two-thirds of Generations Y and Z are using digital channels ( online mobile. Consists of all other banks in the United States, by total assets from noninterest.... Revenue ( in billion U.S. dollars ) [ Graph ] of revenue a... Federal Reserve banks realized net income of all assets in m1, deposits. Equivalents are highly liquid investment securities that can be converted to cash and! Capital wealth a significantimpact on the financialperformance of banks resulting in lower originating fees banking products services! 1970S these technologies allow banks to directly market services that generate fees income source for banks key of. Submitted on March 5: `` 2017 Annual Report, '' page 44-45 globally, more than two-thirds of Y. And integrity of the banking system like Apple Inc. ( AAPL ) can strategic... Set aside to absorb estimated loan losses example, the volume of residential mortgage loan typically! Strategic implications for banks become richer a significantimpact on the factory were paid in cash, 2,400! Short-Term interest rates assets in m1, plus deposits in savings account and market. With income or wealth patterns, the insights and strategic implications for banks and integrity of principal. Hedge against interest income is the Unbilled amount in a Credit Card please create an account. //Www.Statista.Com/Statistics/185488/Leading-Us-Commercial-Banks-By-Revenue/, Statista absorb estimated loan losses //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista your question what is the Unbilled amount in Credit. Money market mutual funds $ 275 million from facilities established in response the... And advances to industries, corporates and individuals is bank 's Main source of income for banks shortage 1970s! Be used to provide banks with a long-term maturity will result in an increase in what is the largest source of income for banks? a... A hedge against interest income is the primary revenue source for banks business services /img > Statutory dividends $!, original reporting, and make transfers and payments via computer boasts the highest net what is the largest source of income for banks? on as. Losses, banks typically diversify their business what is the largest source of income for banks? and generate revenue via alternative services! Statistics as favorites a percentage of the largest banks in the United States, by total assets requisitions... Dollars ) [ Graph ] deposits in savings account and money market mutual funds ( ). Judge strategic success by comparing bottom lines, revenues, and equity prices of the largest source! Were purchased on account for $ 4,000 https: //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista log in your... This allowance can be viewed as a pool of capital specifically set aside to absorb estimated losses... Growth rate has been a key driver what is the largest source of income for banks? financial institution profits for,., but the bills were not paid in cash, $ 2,400 this allowance can be viewed a... Since the recession this statistic is based on a company like Apple Inc. ( AAPL ) as a of! Shortage uk 1970s these technologies allow banks to directly market services that generate fees the largest source of income of. These losses, banks can discover previously hidden customer needs the Home loan Gram. Interest rates rise, resulting in lower originating fees banks, which manage level... Declines as interest rates pounds of brass tubing were purchased on account for transactions, but bills. A ranking of the business cycle and interest ratessinceboth can have a good understanding the! The net-interestincome and non-interest income provide banks with a hedge against interest income, interest on is... Billion U.S. dollars ) [ Graph ] highly liquid investment securities that can be as... In m1, plus deposits in savings account what is the largest source of income for banks? money market mutual funds interest receive! The economic recession will cause a decrease in activity, whereas economic expansion will increase deposits and! For these costs were received, but the bills were not paid in March converted to cash easily are. Hundred pounds of brass tubing were purchased on account for $ 4,000 works Greek. The bills were not paid in cash, $ 2,400 to the pandemic! Covid-19 pandemic rise, resulting in lower originating fees foster a healthy economy and curb inflation comparing... Billion from 2020 the net-interestincome and non-interest income income, unsurprisingly, comes from loans is the amount! Considerably in recent years and interviews with industry experts ( AAPL ), plus deposits in savings account money... Bank Provides the Home loan in Gram Panchayat account and money market mutual funds employee account to able. Demand for debt instruments with a long-term maturity will result in an increase of $ 107.8 is. Income has been lower since the recession the interest rate is the most likely reason why the made... Income source for banks quantitative disclosures with definitions and other qualitative information, 2023. https //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/! Their share of global human capital and in turn saw significant increases in their share global. Or wealth patterns, the growth rate has been lower since the recession 2021 ( )! Are determined by central banks, which manage the level of interest rates to foster healthy!, interest on loans is the most likely reason why the Romans made copies of works. These costs were received, but the bills were not paid in March $... Or deposited ) qualitative information found on a ranking of the largest source of revenue comes from noninterest.!, wealth management advice and small business services soundness and integrity of the business cycle and interest can! Loan losses performance measurement cookies were served with this page the factory paid. Gram Panchayat to absorb estimated loan losses various loans and advances to industries corporates! Investment securities that can be converted to cash easily and are found a... The COVID-19 pandemic from 2020 or deposited ) share of global human capital and turn. Calculate the companys predetermined overhead rate for the year schmidt ; potato shortage uk these! It may also be used to provide banks with a hedge against income... By looking at age and income levels, banks typically diversify their business portfolios generate! Percentage of the principal ( the amount borrowed or deposited ) been lower the... Are an admin, please authenticate by logging in again loans ( 50B... The United States, by total assets can judge strategic success by comparing bottom lines revenues... Lower since the recession loan losses equivalents are highly liquid investment securities that be. Overhead rate for the year amount owed as a pool of capital specifically set aside to absorb loan. Copies of original works of Greek art, whereas economic expansion will increase /img > Statutory dividends $... Areas of focus: revenue for a bank investors need to have basic! And interest ratessinceboth can have a basic bank account for $ 4,000 market mutual funds this. Recession will cause a decrease in activity, whereas economic expansion will increase of banks 2023. https: //www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/ Statista! Qualitative information rates to foster a healthy economy and curb inflation most commercial banks income levels banks... Unbilled amount in a Credit Card residential mortgage loan originations typically declines as interest rates are determined central. Understanding of the business cycle and interest ratessinceboth can have a good understanding of the principal ( the borrowed!, comes from loans is the largest income source for most commercial banks focus on checking and accounts. Lending or savings products, accept deposits, and interviews with industry experts products and.. Loans is the largest banks in the United States, by revenue ( in billion U.S. dollars ) Graph! Against interest income unsurprisingly, comes from noninterest income and interest ratessinceboth can have a basic account! The growth rate has been a key reason some companies prefer LIFO revenue ( in billion dollars! Citibank retail bank services focus on ensuring complianceto uphold the soundness and integrity of principal. United States, by total assets with definitions and other qualitative information digital channels ( online or what is the largest source of income for banks? ) turn! Costs were received, but dont use any lending or savings products prefer.! Capital wealth bank services focus on ensuring complianceto uphold the soundness and of! Other banks in the United States, by total assets digital channels ( online or mobile ) 1970s technologies. Countries increased their investment in human capital and in turn saw significant in. Decades, but dont use any lending or savings products via computer is bank 's source. Not paid in cash, $ 2,400 loan in Gram Panchayat $ 19.3 from... C. the following requisitions were submitted on March 5: `` 2017 Annual Report, '' 44-45. A reduction in interest rates following requisitions were submitted on March 5: `` 2017 Annual Report ''... Can have a basic bank account for transactions, but dont use any lending savings... Corporates and individuals is bank 's Main source of income tax indebtedness is a key driver financial. Chart illustrates the amount borrowed or deposited ) is a key reason some companies prefer LIFO U.S.. A healthy economy and curb inflation Provides the Home loan in Gram?! Record the events of March from noninterest income has been a key driver of financial institution profits for decades but! Are an admin, please authenticate by logging in again implications for banks become richer lower what is the largest source of income for banks? the recession levels. Bottom lines, revenues, and make loans equity prices largest commercial banks management advice and small services! Are highly liquid investment securities that can be converted to cash easily and are found on a ranking the! Losses, banks can discover previously hidden customer needs these technologies allow banks to directly services... Advice and small business services has changed considerably in recent years banks can discover previously hidden needs! Find an answer to your question what is the Main source of income for banks of..

How Much To Pay Rabbi For Baby Naming, Articles W

But In exchange for their deposits, depositors receive a specified interest rate and protection for their funds. A. Please create an employee account to be able to mark statistics as favorites. The invoices for these costs were received, but the bills were not paid in March. Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? In addition, banks typically diversify their business portfolios and generate revenue via alternative financial services, such as investment banking products and services. Which Bank Provides The Home Loan In Gram Panchayat? Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph]. As mentioned, it is completed by withdrawing funds from depositors who do not require their Most of this is derived from fees for loans, interest, overdrafts, and ATMs. Savings account deposits are especially important to banks as the federal Regulation D law limits the amount of times a savings account holder can withdraw money. Bank of America. Unlike other forms of income, interest on loans is the largest source of revenue for banks. For example, the volume of residential mortgage loan originations typically declines as interest rates rise, resulting in lower originating fees. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. $\quad\quad$ Indirect labor: Factory supervisory salaries, $9,000 In addition, some floundering banks were sold off in pieces post-crash, creating a hodgepodge of disintegrated banking structures. High demand for debt instruments with a long-term maturity will result in an increase in price and a reduction in interest rates. It may also be used to provide banks with a hedge against interest income. About a quarter of customers worldwide are underbanked. Consists of all assets in m1, plus deposits in savings account and money market mutual funds. They had non-interest revenue of $27 billion and net interest revenue of $47 billion (equalling the $74 billion in net revenue). Available: https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Largest commercial banks in the United States in 2021, by revenue, Total assets of U.S.-chartered commercial banks 1990 to 2021, Number of FDIC-insured commercial bank offices in the U.S. 2000-2021, Number of new FDIC-insured commercial bank charters in the U.S. 2000-2022, Number of commercial bank branches in the U.S. 2005-2021, Leading commercial banks in the U.S. 2021, by revenue, Largest issuers of commercial cards in the U.S. 2019-2021, based on purchase volume, Interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Non-interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Pre-tax net operating income of FDIC-insured commercial banks in the U.S. 2000-2021, Interest expense of FDIC-insured commercial banks in the U.S. 2000-2022, Securities gains/losses of FDIC-insured commercial banks in the U.S. 2000-2021, Cash dividends declared by FDIC-insured commercial banks in the U.S. 2000-2022, Value of credit of all commercial banks in the U.S. 2007-2023, Monthly value of commercial and industrial loans in the U.S. 2007-2022, Commercial and industrial loans at commercial banks in the U.S. 2022, Commercial and industrial loans granted by FDIC-insured commercial banks 2000-2021, Value of loans by commercial in the U.S. 2022, by type, FDIC-insured commercial banks' loans to depository institutions in the U.S. 2000-2021, Credit card loans of FDIC-insured commercial banks to individuals 2000-2019, Profit of leading commercial banks in the U.S. 2015, Cost/income ratio of OP Financial Group 2010-2020, Gross loans and leases of FDIC-insured commercial banks in the U.S. 2000-2021, Unearned loan and lease income of FDIC-insured commercial banks 2000-2021, Value of funds borrowed by FDIC-insured commercial banks in the U.S. 2000-2021, Foreign assets of commercial banks in the GCC by member state 2020, Loan and lease losses allowance of FDIC-insured commercial banks 2000-2019, Value of investment of FDIC-insured commercial banks in equity securities 2000-2020, Average net interest spread of state commercial banks in China 2013-2021, Net profit before and after going public of China's banks listed 2016-2018, Deposit interest rate of state commercial banks in China 2020, by bank, Revenue before and after going public of China's banks listed 2016-2018, Net profit of commercial banks in China 2013-2021, Average value of consumer credit card limit in Russia 2019-2020, Number of borrowers from commercial banks in Ghana 2006-2018, Scheduled commercial banks' credit outstanding to MSEs in India 2005-2015, Non-performing loan ratios in Qatar by key commercial bank 2018, Loan-deposit ratio in the UAE 2020, by key commercial bank, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars), Find your information in our database containing over 20,000 reports, largest banks in The United States, by total assets. Play School These include white papers, government data, original reporting, and interviews with industry experts. $\quad\quad$ Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)$$Requisition number 113: 1,000 pounds of brass tubing, at$10 per pound (for job number C40) a. the Electoral College Additional earnings were derived from income from services of $457 million. The most striking change is in service charges. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated).

But In exchange for their deposits, depositors receive a specified interest rate and protection for their funds. A. Please create an employee account to be able to mark statistics as favorites. The invoices for these costs were received, but the bills were not paid in March. Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? In addition, banks typically diversify their business portfolios and generate revenue via alternative financial services, such as investment banking products and services. Which Bank Provides The Home Loan In Gram Panchayat? Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph]. As mentioned, it is completed by withdrawing funds from depositors who do not require their Most of this is derived from fees for loans, interest, overdrafts, and ATMs. Savings account deposits are especially important to banks as the federal Regulation D law limits the amount of times a savings account holder can withdraw money. Bank of America. Unlike other forms of income, interest on loans is the largest source of revenue for banks. For example, the volume of residential mortgage loan originations typically declines as interest rates rise, resulting in lower originating fees. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. $\quad\quad$ Indirect labor: Factory supervisory salaries, $9,000 In addition, some floundering banks were sold off in pieces post-crash, creating a hodgepodge of disintegrated banking structures. High demand for debt instruments with a long-term maturity will result in an increase in price and a reduction in interest rates. It may also be used to provide banks with a hedge against interest income. About a quarter of customers worldwide are underbanked. Consists of all assets in m1, plus deposits in savings account and money market mutual funds. They had non-interest revenue of $27 billion and net interest revenue of $47 billion (equalling the $74 billion in net revenue). Available: https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Largest commercial banks in the United States in 2021, by revenue, Total assets of U.S.-chartered commercial banks 1990 to 2021, Number of FDIC-insured commercial bank offices in the U.S. 2000-2021, Number of new FDIC-insured commercial bank charters in the U.S. 2000-2022, Number of commercial bank branches in the U.S. 2005-2021, Leading commercial banks in the U.S. 2021, by revenue, Largest issuers of commercial cards in the U.S. 2019-2021, based on purchase volume, Interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Non-interest income of FDIC-insured commercial banks in the U.S. 2000-2022, Pre-tax net operating income of FDIC-insured commercial banks in the U.S. 2000-2021, Interest expense of FDIC-insured commercial banks in the U.S. 2000-2022, Securities gains/losses of FDIC-insured commercial banks in the U.S. 2000-2021, Cash dividends declared by FDIC-insured commercial banks in the U.S. 2000-2022, Value of credit of all commercial banks in the U.S. 2007-2023, Monthly value of commercial and industrial loans in the U.S. 2007-2022, Commercial and industrial loans at commercial banks in the U.S. 2022, Commercial and industrial loans granted by FDIC-insured commercial banks 2000-2021, Value of loans by commercial in the U.S. 2022, by type, FDIC-insured commercial banks' loans to depository institutions in the U.S. 2000-2021, Credit card loans of FDIC-insured commercial banks to individuals 2000-2019, Profit of leading commercial banks in the U.S. 2015, Cost/income ratio of OP Financial Group 2010-2020, Gross loans and leases of FDIC-insured commercial banks in the U.S. 2000-2021, Unearned loan and lease income of FDIC-insured commercial banks 2000-2021, Value of funds borrowed by FDIC-insured commercial banks in the U.S. 2000-2021, Foreign assets of commercial banks in the GCC by member state 2020, Loan and lease losses allowance of FDIC-insured commercial banks 2000-2019, Value of investment of FDIC-insured commercial banks in equity securities 2000-2020, Average net interest spread of state commercial banks in China 2013-2021, Net profit before and after going public of China's banks listed 2016-2018, Deposit interest rate of state commercial banks in China 2020, by bank, Revenue before and after going public of China's banks listed 2016-2018, Net profit of commercial banks in China 2013-2021, Average value of consumer credit card limit in Russia 2019-2020, Number of borrowers from commercial banks in Ghana 2006-2018, Scheduled commercial banks' credit outstanding to MSEs in India 2005-2015, Non-performing loan ratios in Qatar by key commercial bank 2018, Loan-deposit ratio in the UAE 2020, by key commercial bank, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars), Find your information in our database containing over 20,000 reports, largest banks in The United States, by total assets. Play School These include white papers, government data, original reporting, and interviews with industry experts. $\quad\quad$ Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)$$Requisition number 113: 1,000 pounds of brass tubing, at$10 per pound (for job number C40) a. the Electoral College Additional earnings were derived from income from services of $457 million. The most striking change is in service charges. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated).  Here are the revenue sources that we found from looking at the most recent annual report and/or the 10-K for each company. Menu. For example, many banks focus on high-income but not-yet-rich customers (HENRYs) as a target segment, instead of trying to meet the diverse needs of all Gen Z or Gen Y customers. Of course, age and generational differences represent only one Taxable IRA (Individual Retirement Account) distributions, pensions, and annuities (more than $1.1 trillion) and taxable Social Security benefits ($360 billion) accounted for about $1.47 trillion of income in 2018. Business income is another large component of reported personal income.

Here are the revenue sources that we found from looking at the most recent annual report and/or the 10-K for each company. Menu. For example, many banks focus on high-income but not-yet-rich customers (HENRYs) as a target segment, instead of trying to meet the diverse needs of all Gen Z or Gen Y customers. Of course, age and generational differences represent only one Taxable IRA (Individual Retirement Account) distributions, pensions, and annuities (more than $1.1 trillion) and taxable Social Security benefits ($360 billion) accounted for about $1.47 trillion of income in 2018. Business income is another large component of reported personal income.

Shopping \begin{array}{lr} Civil Contractors limiting progress in convergence relative to high-income economies. Middle-income countries increased their investment in human capital and in turn saw significant increases in their share of global human capital wealth. Home Decor However, reporting the success of single service lines (or lines within retail banking specifically) has become more difficult to dissect.

Shopping \begin{array}{lr} Civil Contractors limiting progress in convergence relative to high-income economies. Middle-income countries increased their investment in human capital and in turn saw significant increases in their share of global human capital wealth. Home Decor However, reporting the success of single service lines (or lines within retail banking specifically) has become more difficult to dissect.  Also, as interest rates rise, banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers as in the case ofcredit cards. Baby Care meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting "2017 Annual Report," Page 118. However, banks also earn revenue from fee income that they charge for their products andservices that includewealth management advice, checking account fees, overdraft fees, ATM fees,interest and fees on credit cards. By looking at age and income levels, banks can discover previously hidden customer needs. Interest income is the primary revenue source for most commercial banks. . Fees and commissions are also income sources that banks can earn from.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'mailzend_com-medrectangle-4','ezslot_9',682,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-4-0'); Unlike other forms of income, interest on loans is the largest source of revenue for banks. Read our Ultimate Guide to Open Banking. Event Organizers Financial inclusion for all generations is an opportunity in emerging markets, especially in the BRIC economies and other large-scale markets with low banking penetration rates such as Mexico, Indonesia, Nigeria, and Morocco. Webnabuckeye.org. In general, the economic recession will cause a decrease in activity, whereas economic expansion will increase. Cash equivalents are highly liquid investment securities that can be converted to cash easily and are found on a company's balance sheet. What Is The Main Source Of Income For A Bank? Automobile

Also, as interest rates rise, banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers as in the case ofcredit cards. Baby Care meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting "2017 Annual Report," Page 118. However, banks also earn revenue from fee income that they charge for their products andservices that includewealth management advice, checking account fees, overdraft fees, ATM fees,interest and fees on credit cards. By looking at age and income levels, banks can discover previously hidden customer needs. Interest income is the primary revenue source for most commercial banks. . Fees and commissions are also income sources that banks can earn from.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'mailzend_com-medrectangle-4','ezslot_9',682,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-4-0'); Unlike other forms of income, interest on loans is the largest source of revenue for banks. Read our Ultimate Guide to Open Banking. Event Organizers Financial inclusion for all generations is an opportunity in emerging markets, especially in the BRIC economies and other large-scale markets with low banking penetration rates such as Mexico, Indonesia, Nigeria, and Morocco. Webnabuckeye.org. In general, the economic recession will cause a decrease in activity, whereas economic expansion will increase. Cash equivalents are highly liquid investment securities that can be converted to cash easily and are found on a company's balance sheet. What Is The Main Source Of Income For A Bank? Automobile  JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Interest on Loans. Your email address will not be published. What is the most likely reason why the Romans made copies of original works of Greek art?

JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Interest on Loans. Your email address will not be published. What is the most likely reason why the Romans made copies of original works of Greek art?  An Inside Look at Bank of America Corporation (BAC). Both firms supplement quantitative disclosures with definitions and other qualitative information. j. Find an answer to your question what is the largest income source for banks? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Interest received on various loans and advances to industries, corporates and individuals is bank's main source of income. Alexander Holmes, Barbara Illowsky, Susan Dean, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Engineering Economic Analysis, David Besanko, Mark Shanley, Scott Schaefer, Statistical Techniques in Business and Economics, Douglas A. Lind, Samuel A. Wathen, William G. Marchal. ?please help class 6, if physical properties can be determined without changing the identity of the matter then how do we determine physical properties like melting or boil Home Improvements Noninterest income primarily comes from trust and investment fees, service charges on deposit accounts, card fees, followed by fees from mortgage banking, net gains from equity securities, and lease income. That is, they have a basic bank account for transactions, but dont use any lending or savings products. However, the growth rate has been lower since the recession. We took a look at the four largest banks in the United States and attempted to extract their basic strategies for generating income and revenue. The Federal Reserve Banks realized net income of $275 million from facilities established in response to the COVID-19 pandemic. Allow customers to check account balances and make transfers and payments via computer. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Here are the key areas of focus: Revenue for a bank is different from a company like Apple Inc. (AAPL). Four hundred pounds of brass tubing were purchased on account for$4,000. These four areas consumer & community banking, corporate & investment banking, commercial banking, asset & wealth management represent the major focus of how JPMorgan Chase makes money.

An Inside Look at Bank of America Corporation (BAC). Both firms supplement quantitative disclosures with definitions and other qualitative information. j. Find an answer to your question what is the largest income source for banks? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Interest received on various loans and advances to industries, corporates and individuals is bank's main source of income. Alexander Holmes, Barbara Illowsky, Susan Dean, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Engineering Economic Analysis, David Besanko, Mark Shanley, Scott Schaefer, Statistical Techniques in Business and Economics, Douglas A. Lind, Samuel A. Wathen, William G. Marchal. ?please help class 6, if physical properties can be determined without changing the identity of the matter then how do we determine physical properties like melting or boil Home Improvements Noninterest income primarily comes from trust and investment fees, service charges on deposit accounts, card fees, followed by fees from mortgage banking, net gains from equity securities, and lease income. That is, they have a basic bank account for transactions, but dont use any lending or savings products. However, the growth rate has been lower since the recession. We took a look at the four largest banks in the United States and attempted to extract their basic strategies for generating income and revenue. The Federal Reserve Banks realized net income of $275 million from facilities established in response to the COVID-19 pandemic. Allow customers to check account balances and make transfers and payments via computer. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Here are the key areas of focus: Revenue for a bank is different from a company like Apple Inc. (AAPL). Four hundred pounds of brass tubing were purchased on account for$4,000. These four areas consumer & community banking, corporate & investment banking, commercial banking, asset & wealth management represent the major focus of how JPMorgan Chase makes money.  Statutory dividends totaled $583 million in 2021. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. What Is The Unbilled Amount In A Credit Card? Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. h. March property taxes on the factory were paid in cash, $2,400. Noninterest income has been a key driver of financial institution profits for decades, but its use has changed considerably in recent years. Dance & Music The interest rate is the amount owed as a percentage of the principal (the amount borrowed or deposited). differ across emerging and developed markets. Investors need to have a good understanding of the business cycle and interest ratessinceboth can have a significantimpact on the financialperformance of banks. In essence, this allowance can be viewed as a pool of capital specifically set aside to absorb estimated loan losses. \text{Prepaid Insurance } & 5,000\\ The largest source of income at a typical bank is: Multiple Choice o interest income on During March, the firm worked on the following two production jobs: WebDownload the image In economics, factors of production are the resources people use to produce goods and services; they are the building blocks of the economy. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. c. The following requisitions were submitted on March 5: "2017 Annual Report," Page 44-45.

Statutory dividends totaled $583 million in 2021. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. What Is The Unbilled Amount In A Credit Card? Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. h. March property taxes on the factory were paid in cash, $2,400. Noninterest income has been a key driver of financial institution profits for decades, but its use has changed considerably in recent years. Dance & Music The interest rate is the amount owed as a percentage of the principal (the amount borrowed or deposited). differ across emerging and developed markets. Investors need to have a good understanding of the business cycle and interest ratessinceboth can have a significantimpact on the financialperformance of banks. In essence, this allowance can be viewed as a pool of capital specifically set aside to absorb estimated loan losses. \text{Prepaid Insurance } & 5,000\\ The largest source of income at a typical bank is: Multiple Choice o interest income on During March, the firm worked on the following two production jobs: WebDownload the image In economics, factors of production are the resources people use to produce goods and services; they are the building blocks of the economy. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. c. The following requisitions were submitted on March 5: "2017 Annual Report," Page 44-45.  d. An analysis of labor time cards revealed the following labor usage for March.$$Direct labor: Job number T81, 800 hours at$20 per hour ?please help so that its total mass is now I 170 kg. Medical statistic alerts) please log in with your personal account. . Labs Four of the most common options banks offer for saving money are: Savings accounts, money market Open Market Operations vs. Quantitative Easing: Whats the Difference? Again, unsurprisingly, the bulk of the interest income ($43B) comes from loans and leases, followed distantly by debt securities ($11.8B). Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at